JES' stock up on news of its first offshore contract

JES International's stock price shot up as much as 6% to 15.8 cents this morning following its announcement of another shipbuilding contract within three weeks.

The latest contract stands out because it is the Group’s first -- in its history of more than 30 years -- for the construction of an offshore support vessel.

Venturing into the robust offshore oil and gas sector, JES aims to expand from building commercial shipping vessels to constructing more complicated and sophisticated offshore support vessels.

The contract was secured from a new customer based in Norway.

Delivery of the vessel is expected to take place at the end of FY2014.

In the other contract announcement, made on 19 September, JES said it would be building for a Germany customer a 94,000 DWT bulk carrier.

The delivery of the vessel is expected to take place in 2014. There is an option for a second similar vessel.

Listed on the SGX Mainboard since 2007, JES (www.jes-intl.com/) is a major PRC shipbuilding group which has built bulk carriers, oil tankers, containerships and ocean engineering vessels.

It operates from its shipyard located at Shiwei Port, Jingjiang City, Jiangsu Province.

Based on a recent stock price of 15.4 cents, JES stock trades at 10.4 X PE and sports a market cap of S$180 million.

Read about NextInsight's 2009 visit to JES' shipyard: JES: 'When economy picks up, we'll overperform'

Excerpts from OCBC Investment Research's report this morning on Viz Branz

Analysts: Lim Siyi & Andy Wong

NEW SUBSTANTIAL SHAREHOLDER

• Lam Soon acquires 20% stake

• Reduced stake for CEO signals intent to leave

• GO still distinct possibility

Partial stake sold to Lam Soon. Viz Branz (VB) announced yesterday that its current CEO, Mr. Chng Beng Beng, sold 57m shares (~16.1% ownership stake) to Lam Soon Cannery Private Limited at a price of S$0.735/share, which reduces his stake in VB from 35.9% to 19.8%.

In addition, Lam Soon purchased a further 14m shares in a series of married trades from smaller shareholders to bring its total current stake to 19.8%.

While these series of share purchases fall short of triggering a general offer - as it is less than the 30% threshold - we view this development as a positive and an important first step for an eventual overall takeover.

An eventual GO is still likely. Maintain HOLD. A reduced stake for VB's CEO is clear indication of his intent to leave the business eventually.

Therefore, a subsequent sale to Lam Soon and a corresponding general offer is still a distinct possibility.

However, valuations are likely to be capped at S$0.735/share, which is 0.7% lower than our fair value estimate of S$0.74/share. Maintain HOLD.

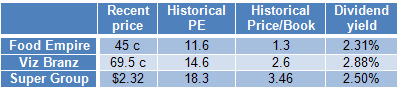

Related story: FOOD EMPIRE: Making hot coffee for Russians & others