This article was recently published on www.nracapital.com and is reproduced with permission

Adding Straco Corporation to my Yield Stock Picks to replace.......Cerebos which is being privatised Monday

With the privatisation and delisting of Cerebos, I was looking for a yield stock replacement that was in a defensive industry and which had a strong balance sheet to weather any storm that might suddenly surface from the EU, Middle East or even Asia.

The latter two are likely to more conflict related than economic. Straco Corporation is one such company and I am adding it today to my Yield Stock list.

About Straco Corporation

Straco Corporation Ltd is in the tourism industry in China where it owns and runs the Shanghai Ocean Aquarium (SOA), Underwater World in Xiamen (UWX) and also a cable car service in Xian.

Although all its businesses are in China, Straco Corporation is not an “S” chip in the sense that its major shareholder Mr Wu Hsioh Kwang, who owns 54.6% of the company is a Singaporean.

Business

About two thirds of Straco’s revenue comes from SOA which is located next the the Pearl Tower in Shanghai and the balance from UWX and its cable car business.

95% of the customers or visitors to SOA and UWX are domestic tourists.

This will insulate Straco’s revenue from the fluctuations in the global economy and its impact on tourist arrivals into China.

The average number of visitors to SOA and UWX in 2009 was 1.8mn.

This figures rose to 2.35mn in 2010 because of the World Expo in Shanghai while UWX saw its visitor growth expand by about 10%.

2011 saw the visitor number normalise to 2.3mn removing the one off effect of the World Expo. Both locations are likely to see sustainable organic growth in visitors of about 10% per annum.

Entrance fees for each location

SOA now charges RMB160 for an adult with RMB110 for children. This fee was increased in November 2011. The blended yield for SOA is about RMB140 per person. For UWX, the entrance fee for adults is RMB90 and RMB50 for children giving a blended figure of RMB68. The entrance fees were last increased in March 2010.

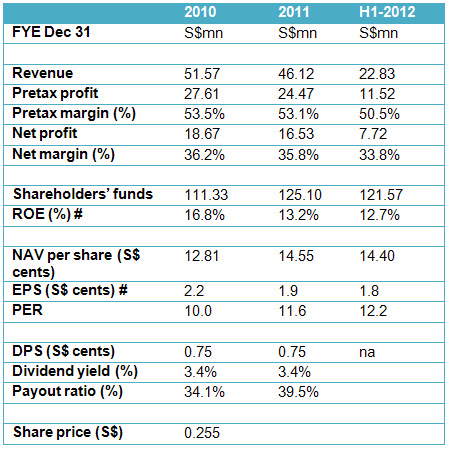

Financials

Straco has a strong balance sheet with net cash of about S$80mn or about S$ 9.4 cents per share.

Company has been buying back its own shares and now has about 24.8mn Treasury shares which are currently used for the directors and employee share option scheme.

Recommendation

Straco Corporation offers direct exposure to the China tourism market but as a domestic play with more than 95% of its current visitors being mainland Chinese.

This figure has been growing steadily at between 5-10% per annum and given China’s total population of more than 1.4bn is likely to see domestic visitors remaining the main customer group over the next five to ten years.

This unique positioning makes its earnings fairly defensive against the economic slowdown in the EU and the US.

Earnings could take a quantum leap if Straco acquires new assets or businesses in the same tourism industry space such as its acquisition of UWX. It is able to do this given its strong cash position and absence of any debt.

The Group has a strong balance sheet with about S$80mn in cash or about 9.4 S cents per share. Over the last few years, Straco has consistently paid about 40% of net earnings as a dividend – but there is scope for this figure to rise given the large cash position as well as its strong free cashflow.

Don’t expect huge capital gains but if you are looking for a defensive play, with a strong balance sheet, a decent dividend yield which is likely to grow at 5-10% per year matching earnings growth, Straco can offer these unique features.

The Company has embarked on a share buyback scheme and has to date purchased about 24-25mn Treasury shares. This should provide downside support on the shares for those investing for the yield.

It's not an “S-Chip” even though its businesses are in China with the major shareholder Mr Wu owning more than 54% of the issued shares. For more on the intrinsic value of Straco read my commentary in my Yield portfolio.

On a cashflow basis, Straco is generating about S$24mn in cashflow per year over the last two to three years – which works out to about 2.8 cents per share giving a price to cashflow of 9.1 times.

Recent story: OTTO MARINE, STRACO CORP: Latest happenings....