This article is reproduced with permission from www.martinlee.sg, a blog focusing on financial matters in Singapore.

THE StockWhiz competition organized by SGX and SIAS almost came to an ominous end when it started last week.

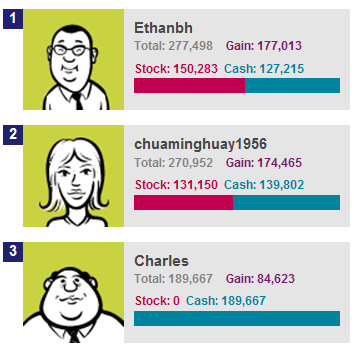

After just a day or two of the 2-month plus competition, the top performers looked something like this (see screenshot at the bottom right).

These were results that would probably put the best traders in the world to shame. It would also put an end to the hopes of all the rest of the contestants.

So what was their secret to doing so well when the movement of the biggest gainer that day was nowhere near?

I have actually signed up for the contest too and have yet to initiate any trades but it didn’t take me long to roughly figure out what they did.

Before I explain what actually happened, let’s look at the objectives of the contest (as given by the organizers):

StockWhiz is an SGX initiative aimed at educating retail investors on prudent investing. Participants can use StockWhiz to learn about creating a diversified portfolio through the tools and research available on My Gateway (http://www.sgx.com/mygateway) and enjoy the learning journey in StockWhiz.

Which I actually find quite ironic because in order to win a 2-month competition, you will probably need to take on excessive risk using a trading strategy to try to beat all the other competitors. Now, I wouldn’t call that prudent investing.

Back to what actually happened.

The thing about a virtual stock market competition is that the volume of trades might not be reflective of the actual market. Thus, it is very easy to move prices in the virtual market by placing trades in the real market if one selects the correct stock.

The ideal target would be those stocks trading at 1 or 2 cents with almost zero liquidity. So, you have a few smart people who figured that out very early on and went on to produce astronomical kind of returns.

Yes, rigging takes place even in a competition!

After numerous complaints (which you can see on Facebook), the rules were amended. One of the change was to remove shares that costs less than $0.20 and void all the transactions of those counters. This removes one of the loophole of the competition.

I had a chuckle when I read one of the replies given by the organizers of StockWhiz :

StockWhiz was launched on 10 September as an initiative to educate retail investors on stock investing as part of a diversified and prudent approach towards preserving savings.

However, we have noticed that some StockWhiz participants have adopted a strategy of frequent transactions on short-term price movements with an undiversified portfolio. Such a trading strategy carries high risks and is not representative of the prudent investing approach investors should embrace.

With this in mind and also following feedback from participants, we are enhancing StockWhiz and ensuring that it mimics more closely the workings of the actual market.

I don’t think a 2-month long competition is the right tool to educate investors on diversified and prudent investing. And other than a major rules overhaul, there’s no way you can deter frequent trading in such a competition.

Previous articles by Martin Lee:

Shipping Stocks and Trusts Battered by Economic Storms

RIGHTS ISSUES: How to deal with them