Excerpts from latest analyst reports.....

Nomura Equity Research is bullish on commodity stocks

> Commodities – Unloved, oversold but good businesses: Commodity traders have underperformed significantly over the past 12 months, following a series of disappointing results and the general pullback in commodity prices.

However we see value in the commodity traders with the average price book of the three listed traders in Singapore at about 1.2x.

Wilmar’s share price has pulled back 27% since the start of the year and is currently trading at a price-to-book value of 1.2x.

We see value in Wilmar and have included it in our top picks for the Singapore portfolio.

In our opinion, Wilmar’s attraction is its strong presence in China and strong processing capabilities in palm oil, sugar and soya beans.

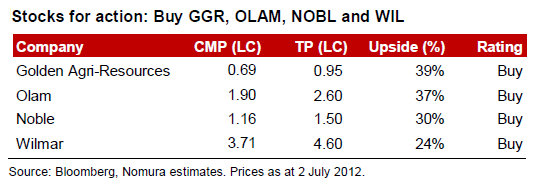

> Bullish on plantations & supply chain: Buy GGR, Olam, Noble and Wilmar.

As with global players, earnings delivery of Asian players has been weak over recent quarters, but the de-rating has been much sharper as Asian stocks were trading at rich multiples before the downturn.

We believe Asian players can continue trading at a premium (higher growth, agri, relatively asset-light) and thus the multiples are now attractive.

We recently turned positive on the space and recently upgraded Wilmar (Buy) and Mewah (Neutral).

For upstream, we stick to stocks with strong correlations to CPO prices, and lower earnings risk. Our top pick for upstream remains GGR.

> Noble looks the most attractive valuation-wise, as it is now trading at 10x CY12F P/E and more importantly, at 1.1x CY12F P/B. The book value should be the absolute floor, in our view.

Recent stories:

OLAM triple buying of shares; SAMKO shareholder continues buying

NOBLE GROUP: Amazing 9,520% return since start of 2001

AmFraser says fair value of YANGZIJIANG SHIPBUILDING is $1.68

Analyst: Lee Yue Jer

Continue to expect 6c dividend: Based on a slightly positive profit outlook, we expect YZJ to at least maintain its 5.5c dividend paid last year, but our money is on a slight increase to 6c, equivalent to a very attractive 5.8% yield.

Buy the strongest player in a weak industry: The entire shipbuilding industry is trading at depressed valuations, and in this climate we advocate buying into the strongest.

The patient investor is being paid to wait with an inflation-beating dividend yield of 5.8%.

The rerating will come eventually, and the risk-reward ratio is extremely appealing now.

We continue to value YZJ at 8x 2012F EPS for a FV of $1.680. Maintain Buy.

Related story: Macquarie welcomes YANGZIJIANG reducing yard capacity