Time & date: 10 am, May 11.

Venue: RiverView Hotel, Havelock Road

HERE IS AN S-chip that is unusual in three respects:

> Its management owns 80 million shares which are unlisted. Only another 35 million shares are listed on SGX, a small number which explains its lack of liquidity.

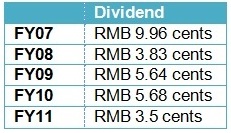

> The company in question -- Fujian Zhenyun Plastics -- pays dividends every year! And it has been profitable since its listing in 2007.

(It made net profit of RMB52.3 million in FY11, but that is down 36.5% year-on-year.)

> Its recent share price was 16 cents but it has net cash of RMB269 million, or 47 Singapore cents a share.

In Singapore dollar terms, it has net cash of S$54 million but a market cap of only S$18 million. The market is not only discounting its cash big-time but according no value to its profitable business.

Here are my takeaways from the AGM last Friday which was attended by about 20 shareholders.

(This stock is discussed in a NextInsight forum thread and we even had an interview story from 2009: FUJIAN ZHENYUN to benefit from China's stimulus package)

1. Real cash? The cash is likely real. Not only the external auditor (Mazars LLP) gave its assurance but also the CFO when asked. CFO Ho Shian Ching said “mei you wen ti” (“there is no issue”). He has been the CFO since listing -- which follows that he knows the company's accounting system inside out and the management pretty well.

Lim Cheng Kee, an independent director who acted as the chairman of the AGM (because company executive chairman Huang Chan Chin was on a business trip), sought to assure shareholders that the cash is real.

A representative of Mazars LLP said the authority to withdraw cash lies with the management and Fujian Zhenyun has internal controls on the withdrawal of cash and “we are happy with the controls, and they are part of our review.”

2. Why the bank borrowings then? This question was asked by shareholder Jimmy Chua (who happens to have an investing blog http://ghchua.blogspot.com/).

He added: Why did two directors provide personal guarantees for some of the loans? Did the banks not trust the cash and the assets that the company has?

The borrowings amounted to only RMB28.8 million (which is paltry compared to the company's cash of RMB298 million).

The CFO said borrowings could be for maintaining relationships with banks (a practice not uncommon among S-chips), or they were made by some subsidiary/subsidiaries as each of them is/are required to be independent when it comes to funding. Also, note that there are subsidiaries that Fujian Zhenyun does not own 100% of.

3. More dividends please? A shareholder repeatedly implored the management to consider a dividend policy with a stated payout ratio, preferably in the 30-40% range instead of the current less-than-10%.

Obviously, the management has heard this many times. According to Independent Director Lim, after the previous AGM, the board decided to pay an interim dividend (RMB2.31 cents) last year for the first time. It continued to pay a final dividend (RMB1.19 cents for FY11) but it had to be lower y-o-y because the 2H11 net profit fell.

Lim said the company needs a cash reserve to support its working capital needs and because, as a SME, it has difficulty obtaining bank loans.

It would also need cash to fund its new Build-Transfer business model of managing the entire project, ranging from manufacturing and supplying pipes to the laying of pipes.

4. Bad debts looming? The cash conversion cycle has worsened from 126 days in FY10 to 164 days in FY11, noted shareholder Jimmy Chua.

Put another way, the company was getting paid slower by its debtors and its inventory was taking longer to be put to work. Why and what is the management doing about it?

Answer from Chen Ling, the deputy GM: Customers were slower in paying because of a credit squeeze. From April, the operating environment improved, leading to better cash collection. The quality of the debt is OK as 70% of sales last year were to local governments.

5. Privatise at IPO price of 62 cents? A shareholder asked for a delisting offer of at least 62 cents, so shareholders can exit from the stock.

At 62 cents, the offer would be attractive not only to shareholders but also the management as it would be at a discount to the company’s Net Asset Value of over S$1 a share, added the shareholder.

“The board has no plan to privatise,” said executive director Fang Bin, however.

6. Progress of Build-Transfer projects? The company is still discussing with local governments on such projects and no deal has been signed.

7. How about bonus shares to improve liquidity? Answer: Fujian Zhenyun is a Chinese-incorporated company and is subject to Chinese regulations, which currently do not allow it to issue new shares. Fujian Zhenyun is one of only 3 Chinese-incorporated companies listed on SGX.

8. My closing thoughts: The stock offers a respectable yield of 4.3% currently but because the management's stake is held through 80m unlisted shares, the level of the stock price is largely irrelevant to them. And their shares cannot be sold on the open market.

On a more positive note, the executive chairman Huang bought 1.6 million listed shares via married deals in January 2012 at 17.5 cents apiece.

Forget about the company delisting. The management sees value in staying as a listed entity, and it would be a challenge for it to be re-listed in another stock exchange in the region, given its small size.

So if you are fine with the dividend yield and can wait patiently for a higher payout when profits recover, the stock could prove to have a favourable risk-reward profile. As for capital gains, we can agree that it wouldn't take much for new interested investors to lift the stock higher and closer to its intrinsic value.

On the other hand, an unlucky outcome could be a stock that stays unloved and unrecognised or goes down further for whatever reason.

What do you think? Share your thoughts in the Comments box below!

For more on the business of Fujian Zhenyun, see our 2009 story: FUJIAN ZHENYUN to benefit from China's stimulus package

For another S-chip trading at a big discount to net cash, see our AGM report: CHINA FIBRETECH: "Ridiculous that the market is pricing it at less than 4 cents"

Comments

I am a full time value investor who moved to Singapore about a year ago. I used to invest HongKong in European markets where I can find some good Cigar butts. I am very happy to notice quite a few s-chip companies are selling very low in Singapore because of different reason.

Thanks for your detailed minutes of the AGM. It is very informative. I plan do a more detailed research on those S-chip companies which show lots of cash on balance sheet and are selling well below net cash such as: Zhen Yun, ChangTian. I will visit there factories in China and talk to their suppliers and customers and employees, is there any advice you would like to give to me. Please send me email: Jason_asee

I just hope he can do something to nudge the management to be pro-minority shareholders by giving out a higher dividend. Plus do something to raise the profile of the company in the market -- currently hardly anyone knows about it.

Also, what is management doing to differentiate the comapny from competitors to get more revenue and profits?

Thanks