Wang Yangang, executive chairman of China Animal Healthcare. NextInsight file photo

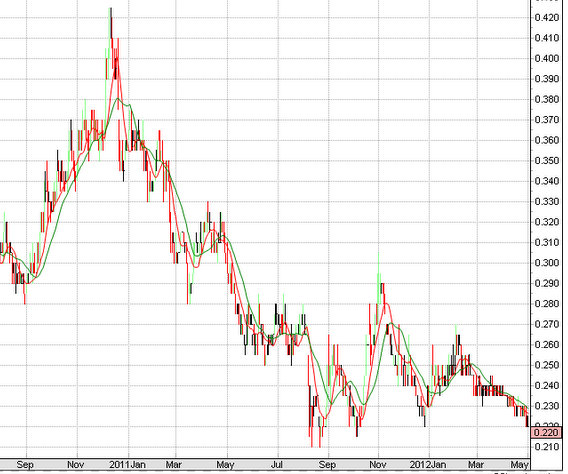

From around 42 cents, it has fallen to around 22 cents.

What has happened? Are CAL's results worse than in FY10?

Are its prospects dimmer than before?

CAL is engaged in the manufacture, sale and distribution of animal drugs. Its chairman, Wang Yan Gang has a deemed interest in 53.3% of the company, which is dual-listed in Singapore and Hong Kong.

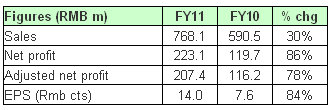

With reference to the table on the right, FY11 revenue and net profit rose 30% and 86% year on year (“y/y”) to RMB768m and RMB223m, respectively.

Excluding the gain in fair value of derivative financial instruments and amortised interest expense relating to the convertible bonds, adjusted net profit would have risen 78% y/y to RMB207m.

Earning per share rose 84% y/y to RMB14.0 cents in FY11.

*(I compared against FY10 results because the historical high share price seen in CAL was observed on 10 and 13 Dec 2010 where the financial year was FY10.)

If not FY11 results, is it due to a weak 1QFY12 results?

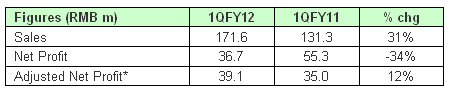

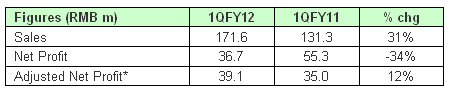

China Animal released its 1QFY12 results on 30 Apr after the market closed. Despite a 31% jump in revenue y/y, net profit dropped 34%. (See table below).

However, if we exclude the gain in fair value of derivative financial instruments and amortised interest expense relating to the convertible bonds, adjusted net profit would have grown by 12% y/y.

It is also noteworthy that for 1QFY12, amortization expenses pertaining to the production technology rights for the animal FMD vaccines, which commenced in March 2011, amounted to RMB11.5 million in 1Q2012, compared to only RMB3.8 million in 1Q2011.

Thus, if we actually compare “apple to apple”, adjusted net profit could have been higher.

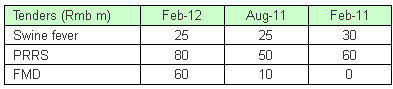

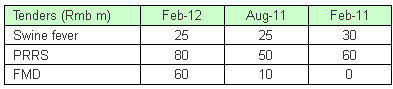

With reference to the table on the right, both PRRS and FMD vaccines have increased relative to Aug and Feb 2011 tenders.

With reference to the table on the right, both PRRS and FMD vaccines have increased relative to Aug and Feb 2011 tenders.

In fact, CAL was able to procure sales for its animal FMD vaccines in 16 provinces and municipalities in Feb 2012, compared to 10 in Aug 2011 tender.

China Animal released its 1QFY12 results on 30 Apr after the market closed. Despite a 31% jump in revenue y/y, net profit dropped 34%. (See table below).

However, if we exclude the gain in fair value of derivative financial instruments and amortised interest expense relating to the convertible bonds, adjusted net profit would have grown by 12% y/y.

It is also noteworthy that for 1QFY12, amortization expenses pertaining to the production technology rights for the animal FMD vaccines, which commenced in March 2011, amounted to RMB11.5 million in 1Q2012, compared to only RMB3.8 million in 1Q2011.

Thus, if we actually compare “apple to apple”, adjusted net profit could have been higher.

How about its prospects?

It is true that CAL has disappointed the market previously as their sales traction in the FMD vaccines was slower than expected.

However, going forward, sales for the FMD vaccines seem to be on an uptrend (albeit from a low base), with a potential recovery in margins, as it slowly gains economies of scale. (FMD has not enjoyed economies of scale yet in 1QFY12).

It is true that CAL has disappointed the market previously as their sales traction in the FMD vaccines was slower than expected.

However, going forward, sales for the FMD vaccines seem to be on an uptrend (albeit from a low base), with a potential recovery in margins, as it slowly gains economies of scale. (FMD has not enjoyed economies of scale yet in 1QFY12).

In fact, CAL was able to procure sales for its animal FMD vaccines in 16 provinces and municipalities in Feb 2012, compared to 10 in Aug 2011 tender.

Furthermore, according to previous results announcements, CAL remains on a quest to export the animal FMD vaccines overseas through joint ventures or OEM arrangement. If this materializes, this should be rather significant in quantum and margins.

Valuations vs peers

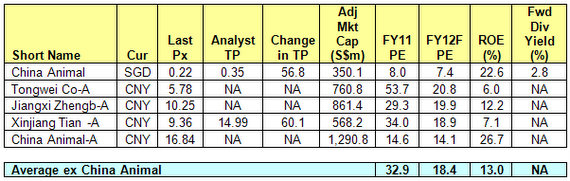

With reference to the table below, CAL trades at 7.4x FY12F PE as compared to the industry average of around 18.4x.

Return on equity is also above the industry average of 13%. Notwithstanding all that, as CAL has disappointed the market before, it may need a few quarters of strong results and good FMD traction (to win over investors) before it can be re-rated.

Visit remisier Ernest Lim's blog http://www.ernestlim15.blogspot.com/

Valuations vs peers

With reference to the table below, CAL trades at 7.4x FY12F PE as compared to the industry average of around 18.4x.

Return on equity is also above the industry average of 13%. Notwithstanding all that, as CAL has disappointed the market before, it may need a few quarters of strong results and good FMD traction (to win over investors) before it can be re-rated.

Visit remisier Ernest Lim's blog http://www.ernestlim15.blogspot.com/