WITH THE dramatic service breakdowns of the past few days, SMRT Corp is in hot soup.

As a result, the CEO, Saw Phaik Hwa, in particular, has been the subject of several media articles which brought up the question of whether she should resign.

While the service breakdowns are technical and customer service issues, it would be interesting to take a look at the financial and stock performance of the company.

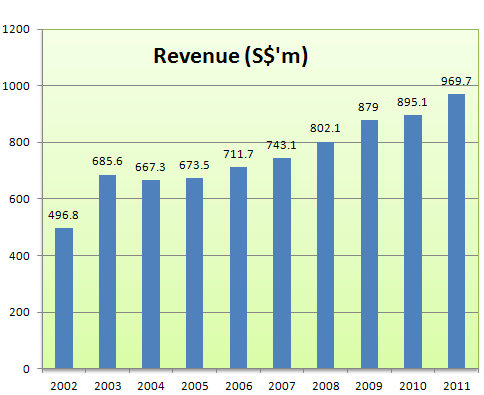

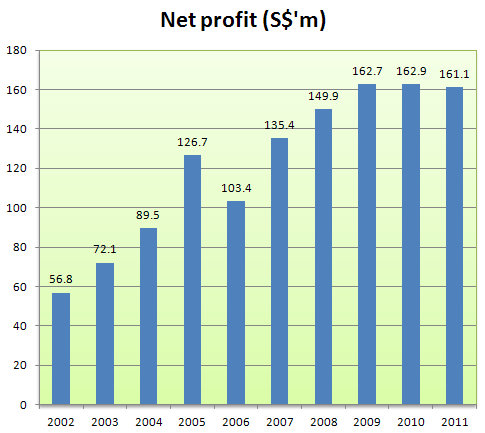

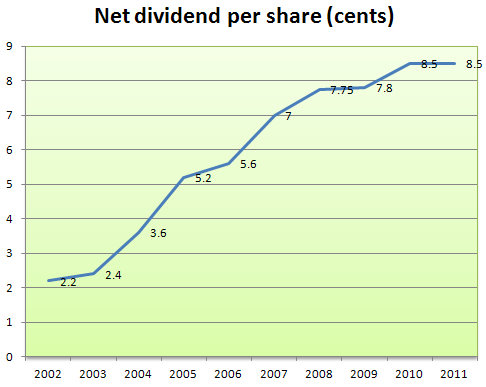

And, we found, that it has grown its revenue, net profit and dividends during Ms Saw's watch from 2002. (See charts below)

The stock price has tracked the business performance, having risen about 150% since the start of 2002 at around 72 cents and closing at $1.82 last Friday.

Add in the net dividends totalling 56.35 cents from FY03 (financial year ended March) to FY11, and the return rises to an excellent 230%. That would place it among the best investments available on the Singapore Exchange -- and, by the way, surprise investors who favour small caps for their higher growth potential.

At a stock price of $1.82, SMRT is a S$2.7 billion company whose stock currently trades at a dividend yield of 4.6%.

Based on the FY11 basic earnings per share of 10.7 cents, the stock trades at 17X PE.

However, the current FY12 is not looking great: Group revenue for 1HFY12 rose 6.8% to $514.2 million but net profit after tax decreased 18.0% to $68.9 million.

SMRT said it expected cost pressures particularly energy costs and staff and related costs to impact the Group’s performance in 3QFY12 and the next 12 months.

It said the profitability of the Group in FY2012 may not be maintained at the previous year’s level.