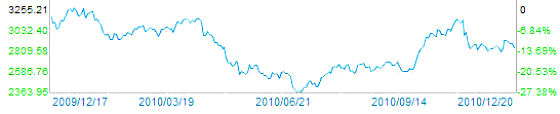

CHINESE SHARES fell for the fourth straight trading day as the market continues struggling to shake jitters over possible interest rate hikes targeting the real estate sector.

The Shanghai Composite, the benchmark index tracking both A and B shares, shed 1.4% to 2,852.92, while Hong Kong’s Hang Seng lost 0.33% to 22,639.08.

The Chinese-language piece in SinaFinance said one worry conspicuously absent from concerns weighing on sentiment in the market today was North Korea’s possible response to South Korea’s live fire exercises today near the two countries’ shared border.

However, there was plenty else on the worry docket to drag down the indices, including a report in the official media earlier today citing the head of the country’s banking watchdog as saying that financing entities tied to local governments represent the top risk to domestic lenders and also are involved in some of the shakiest real estate funding.

As a result, property developers led the downward charge in afternoon trading today after a healthy morning start to the trading week due to worries within the industry that government attempts to increase available land supply will depress prices.

China Vanke Company Ltd (SZA: 000002), the country’s largest listed developer, fell 1.2% to 8.30 yuan while China Merchants Property Development Company Ltd (SZA: 000024) lost 2.1% to 15.99 and Poly Real Estate (Group) Co Ltd (SHA: 600048) was down 1.4% at 12.28 yuan.

The market was also pummeled today after digesting yesterday’s announcement from the Ministry of Land and Resources pressuring regional development authorities to temper land price inflation and keep available a reasonable amount of residential property, a frequent refrain from central authorities extremely keen on both maintaining balanced economic development and nipping potential social unrest in the bud.

The two announcements in two days had the cumulative effect today of bringing the near-term possibility of rate hikes or other anti-speculative measures targeting developers into the spotlight.

This led analysts polled by media to predict that more downside market pressure lay ahead so long at the specter of higher interest rates loomed.

The financial sector, whose fate is closely wed to that of developers in China, also took a hit today on the possibility of Central Bank action.

China’s largest bank Industrial and Commercial Bank of China Limited (ICBC) (SHA: 601398) shed 0.7% to 4.19 yuan while China Construction Bank (SHA: 601939) lost 1.1% to close at 4.66.

See also:

CHINA SHARES Again Flirting With 3,000 As Index Jumps Nearly 3%