|

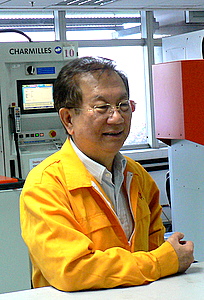

HI-P INTERNATIONAL: The company was into its second week of aggressive share buyback last week, buying a total of 6.588 million shares for a total of over $4 million.

In the previous week, the company bought back 477,000 shares.

Hi-P had earlier given guidance of a better near term future: Revenue for 2Q would be comparable to the corresponding quarter in FY2009, and it would be profitable instead of just breaking even.

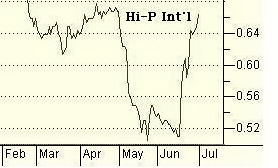

The effect of the guidance and the company buyback on the stock price were pronounced. From 51 cents two weeks ago, the stock has soared to close at 66.5 cents last Friday.

Hi-P (market cap: S$590.million) provides manufacturing services and electro-mechanical modules to customers in the telecommunications, consumer electronics & electrical, computing, life sciences & medical and automotive industries.

DBS Vickers analyst Tan Ai Teng said in a June 21 report that Hi-P's surge in business momentum was largely driven by the ramp of 1) as much as six to eight new smartphone models vs only two previously for key customer RIM; and 2) a new hit product for Apple which Hi-P has already started to build inventory early in May/June for the seasonally strongest 3Q due to overwhelming demand.

As a result, average capacity utilization has risen from 20-30% to just under 50%, and is expected to continue to trend higher to 70% by 3Q.

Airjet became a substantial shareholder in January this year when it crossed the 5% level with 12.11 million shares.

Mr Chua is chairman and CEO of a listed property group, Ho Bee Investment, which has a market cap of S$1.3 billion (now you know why he is a tycoon).

Teckwah is, well, a low-profile company with no analyst covering it.

It provides printing and packaging services, value chain management services, database management, graphic design, and general services including property management.

He already is among the Top 10 shareholders of Singapore-listed companies such as Anwell Technologies, Sunmart Holdings and Singapore Windsor.

His latest interest, Darco Water (market cap: S$20.8 million), is a provider of integrated engineering and knowledge-based water treatment solutions.

It recently announced that it had secured 22 industrial turnkey projects worth an aggregate of approximately S$8.6 million from customers in the electronic, semi-conductor and solar power manufacturing facilities across Malaysia, Taiwan, and Singapore.

Many NextInsight readers would be familiar with Robert Stone’s name, as he has been featured on this website on several occasions in stories such as the following:

SUNMART's dual-listing (in Korea) news that the market has missed

ANWELL: "My take on its solar biz prospects"

SINGAPORE WINDSOR: Awaiting profit boost from new business