I HAVE BEEN watching Viking since Sept 2009 after I noted that Andy Lim, its chairman, had been increasing his stake in the company.

I began purchasing the stock only in Jul 2010, around the "World Cup" market lull, as Viking’s purchases of Promoter Hydraulics and Marine Accom made sense and came at a seeming bargain to the group.

The total purchase cost was S$29.8 million, of which $25.5 m was in cash.

(These 100% and 55% owned companies, respectively, are a wholesaler of winches, power packs and marine decking equipment, and a turnkey project integrator of accommodation and fit-out.)

Viking makes up 20% of my portfolio, which is quite major to me, as it is made up primarily of warrants and some shares. I would like to increase the holdings but will wait for the results of the integration efforts.

On average, the price per share after conversion is $0.26, compared to the recent mother share price of 20 cents and its net asset value of 14 cents a share as at end-June. I believe that this would be a good long-term buy.

Background

Many would remember Novena Holdings for its furniture business but few would have heard of Catalist-listed Viking Offshore and Marine, although they are the same listed entity. After a management transformation in 2009, Viking went on an acquisition blaze, spending $93m in the past year to acquire complementary businesses, in a bid to form an offshore giant.

On a side note, in Old Norse, Viking means “to go on an expedition”, an appropriate name for a small but aggressive company that could be poised for growth in a fragmented industry.

What makes Viking different?

The strategy adopted by Viking is that of a systems integrator in the marine sector coupled with assets in the FMCG business in Singapore. In the marine sector, there is no known direct competition, given Viking’s solution mix.

While in the FMCG business, recently established Kitoko Kalani, an in-house beauty brand, seems to be bearing fruit. Thus, greenfield segments targeted by Viking seem to be poised for growth, especially with management’s intent to increase overseas revenue mix to 60% (in 2010) from 40% (in 2009).

The subsidiaries within the group are structured for growth with respective CEOs and functional advisory boards, which may in turn increase integration of the various subsidiaries.

Having a technical competence to enhance the structure of the firm, Viking could potentially be a key beneficiary of conversion and specialised shipbuilding in the marine sector as it counts shipbuilding giants clients like Keppel FELS, Otto Marine, Yantai Raffles and Sembawang Shipyard as its clients.

It would prove this competence, if it is able to increase net profit by ten-fold in 2010 based on the company’s most recent management guidance, and maintain decent growth in 2011.

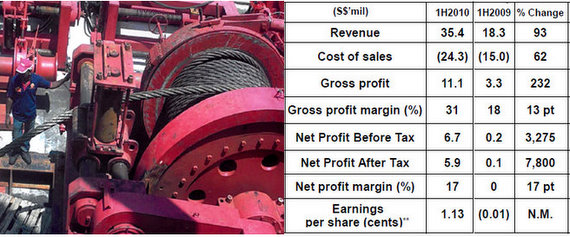

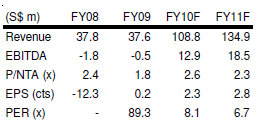

Financials: Headed for 10-fold net profit growth

Viking’s 1H2010 (ended June) after-tax net profit was S$5.9m, while revenue doubled to S$35.4m.

The net profit included S$2.6 million gain (net of fair value losses on other equity) from the disposal of shares in two listed companies – Tung Lok Restaurants and Old Chang Kee.

On Nov 24, management guided for a 10-fold net profit growth this year to $10.5-12 million, and revenue to exceed S$100m on combined contributions from acquired & existing businesses.

On Dec 24, however, Viking said it had pared down its stake in Marine Accom from 55% to 19.86% and, therefore, full-year revenue would instead now be between $80-82 m, instead of $100 m. Viking left its net profit forecast unchanged.

Viking still held S$26 million in quoted securities as at 30 June 2010.

Viking at this point in time, appears to be a promising yet incomplete jigsaw puzzle, which is exposed to potentially more dilution from warrants and staff share issuance.

These factors coupled with the unproven integrated company model, cyclical nature of the marine industry and uncertain macroeconomic factors of the larger economy make Viking’s future seem rather daunting.

But based on the crew assembled, I have decided to be vested in this expedition - bon voyage!

OCBC Investment Research has a ‘buy’ rating and fair value estimate of S$0.32 on the stock.

Comments