LOCAL CONSTRUCTION player, Koon, suffered a contraction in 1H10 top line, but net profit surged 30.9% to S$6.1 million and it wants to diversify revenue streams through M&A.

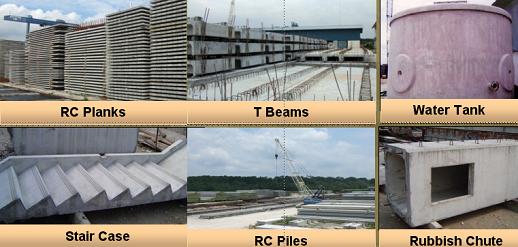

Precasting, a new division purchased in Mar, had maiden sales of S$3.7 million, contributing 8% to top line.

|

Unlike standard concrete, which is poured into site-specific forms and cured on site, precast concrete is casted in a reusable mold or "form" before being transported to the construction site and lifted into place.

This makes it highly efficient for mass housing projects, which the management expects to increase given HDB’s efforts to ease the tight residential market in Singapore.

”We are unlikely to issue equity as the stock is still undervalued and we have ample cash,” said its CEO Tan Thiam Hee during a recent investor briefing.

The company is trading below book value. Based on last close price of 38 cents, price to book is only 0.75x.

Its net cash hoard of S$28.5 million as at Jun amounted to more than 90% of its S$31.2 million market cap.

What’s more, it doubled operating cash flow to S$16.6 million. It also has a huge construction order book of S$267.0 million as at 10 August 2010, to be recognized over the next 2 years.

Other than acquiring a 75% stake in Econ Precast for S$3.75 million on 25 Mar, it also acquired 49% in Aussie energy infrastructure company, Tesla, for S$3.7 million on 30 Jul.

The acquisition grants Koon an immediate foothold in the highly regulated Western Australian energy market, where it plans to construct a 9.9MW diesel power plant that will be completed by the second half of next year.

Tesla has also secured sites for three additional 9.9MW power plants that are pending approval from the Independent Market Operator of Western Australia.

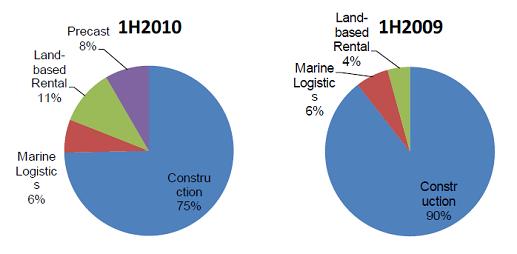

1H10 revenues declined by 43.5% to S$39.6 million due to recognition of fewer construction projects underway and a slowdown in demand for tugs and barges.

The good news is: contributions from the precast division, together with a S$3.4 million reversal of provisions from the construction division helped push gross profits up by 16.7% to S$8.5 million.

Net margins doubled to 15.2%.

The company currently has 4 divisions – namely, construction, marine logistics, land-based rental and precast.

Construction sales generated S$33.0 million, contributing 75% to topline. Koon offers a diverse range of specialist civil engineering services, ranging from soil improvement, dredging and reclamation, infrastructure, shore protection, building marine structures, construction of roads, drains and sewers and power/ sewage plants.

Most of its construction revenues in the next 2 years will come from its maiden overseas project --- to build a port in Vietnam, which adds to its order book by S$225 million.

It has a fleet of 5 tugboats, 14 barges, 2 dredgers and one workboat for charter. Marine logistics contributed S$2.8 million, or 6% to top line.

Leasing of cranes, excavators and other equipment for construction applications contributed S$4.7million, or 11% of top line.

Related story: KOON’S maiden overseas project is worth US$160 million