Photo: BlueFocus

Translated by Andrew Vanburen from a Chinese-language piece in the Shanghai Securities Journal

HONG KONG has long been seen as the center of Greater China’s financial industry.

Being roughly equidistant from major regional markets in Singapore, Beijing, Tokyo and Seoul helps the former British colony bolster that claim.

But if anything is to be judged from the mushrooming of new Mainland-based funds setting up branches in Hong Kong of late – especially if one takes into consideration the investing thrust of these funds – then we are once again reminded of how fast Mainland China has managed over the past couple decades to catch up with Hong Kong in financial sector importance.

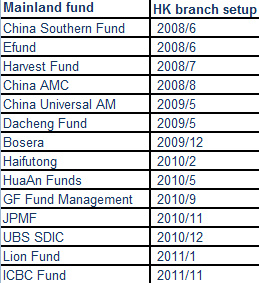

Since the Summer Olympics took Beijing by storm four years ago, some 14 Mainland-based funds have set up local branches in Hong Kong.

All of them should have one common goal in mind – better understanding their behemoth market to the north.

China Southern Fund got the party started, registering itself in Hong Kong back in July of 2008.

In fact, from the outset, the fund was considered a mainland-centric entity that only existed in Hong Kong as a formality of sorts.

Therefore, not only are PRC-sourced funds setting up shop in the Special Administrative Region that is Hong Kong, but they themselves are increasingly focusing their investment strategies on the 1.3-billion consumer strong country market just across the de facto border.

One of the biggest motivators for these funds to establish a presence in Hong Kong is the lure of serving as a conduit to bring Hong Kong capital into PRC-based companies and projects.

But nevertheless, the new arrivals on the scene have not experienced universal success.

Several players have been drowning in the heightened competition for capital and the dog-eat-dog world of unbridled and “operating without a parachute” financial sector environment that is capitalist Hong Kong, with very few imitations of a protected state-owned operator that are more the norm that the exception in the PRC.

Several are no doubt wondering why after having positioned themselves as a “beachhead” to conduit investment capital from Hong Kong to the PRC, why have they not seen the returns that originally seemed available for the picking?

Despite both the PRC technically being part of the same country for 15 years now, there are still cultural differences and barriers between the two, especially in the way a fund management firm is run and perceived, that often make the startups – and clients -- shake their heads in frustration.

A lot may also be asking themselves: “We took the initiative and stepped out into the world, and we are now a brick-and-mortar presence in Hong Kong, the epitome of an ‘international’ city. So now what?”

An international business manager with a Shenzhen-based fund was recently asked by a reporter what new fund firms established in Hong Kong lack compared to international, established competitors.”

“Everything,” he replied.

He said that the Hong Kong-based fund they recently set up has had trouble getting out of a rut, and turnover has only grown in fits and starts – and only by single percentage points at best.

“For our firm to have set up shop in Hong Kong is considered a very major step back in the PRC, and we are considered one of the ‘big boys’,” he said.

“But there is really a significant cultural gap issue at play, and the differences are greater than we originally expected.”

In fact, there is a rather simple solution to this obstacle in the road for PRC-based funds that also hang a shingle in Hong Kong.

Play to your core strengths, and by no means try and reinvent the wheel.

Mainland funds that come to Hong Kong looking to tap global capital should not try and compete head on with the established powers.

Instead, they should be focused like a laser beam on introducing investors to the potential of their homeland.

This way they can trump the “cultural difference” argument by arguing that they are the best candidates to help be a bridge between global capital (read: Hong Kong money) and the People’s Republic.

Indeed, a quick study of the 14 funds that set up shop in Hong Kong since 2008 will reveal that the one’s whose phones are ringing the loudest are those with a focus on the Mainland.

See also:

CHINA’S LADY BUFFETT: Liu Ying Making Splash In Hong Kong

ALEX WONG: Don’t Let Gyrations Make Gamblers Of Us