Photo: Comtec Solar

COMTEC SOLAR achieves 10% gross margin despite ‘volatile market’

COMTEC SOLAR Systems Group Ltd (HK: 712), a global leader in monocrystalline solar wafer production, said its July-September gross profit margin was 10% despite weak selling prices and intense competition.

“Leveraging on our competitive advantages in production technology, cost controls and product quality as well as the commercial launch of our Super Mono Wafers, we were able to achieve profitable operations and recorded remarkable gross profit margins of 10% under an extremely challenging and volatile market environment,” said Comtec Chairman John Zhang.

Comtec Solar’s third quarter consolidated turnover was 256.0 mln yuan, down from 280.4 mln a year earlier.

Meanwhile, its bottom line came in at 5.1 mln yuan, compared to 80.8 mln in the third quarter of 2010.

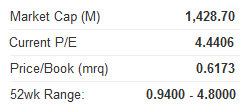

Its current P/E ratio stands at just 4.4x, far below the industry average of 14.2x, making it an interesting stock to monitor should an order spike occur.

Comtec said it maintained a “healthy” financial position with aggregate cash and cash equivalents of approximately 660.7 mln yuan and net debts amounting to approximately 11.4 mln.

“During the third quarter 2011, the ASP of solar products dropped approximately 30% worldwide. However, our monthly shipment volume, revenue and gross margin improved every month during the quarter. We will try our best to maintain this remarkable trend in the coming months.

“Also, we will accelerate the migration of our product portfolio from the traditional P-type wafers to Super Mono wafers and we are optimistic regarding our business prospects,” Mr. Zhang added.

The company was not immune to the financial woes hounding the EU, a major market for solar products.

“Amidst the debt crisis in Europe and the challenging market landscape with substantial excess capacity, we consider it would be in the best interests of the company to reconsider our original expansion plan. Meanwhile, we will strive to keep differentiating ourselves by offering value-added products with premium quality to customers.

“We expect the consolation in the solar industry to continue. It is important to maintain profitable operations and to preserve a healthy financial position for the survival and long term success of our company,” Mr Zhang concluded.

See also:

ANWELL: Why China Municipal Government Injected Rmb 800 Million

COMBINE WILL Q3 Top Line Up 18% Scene at Combine Will factory in Dongguan. NextInsight file photoCOMBINE WILL International Holdings Ltd (SGX: COMW) said its third quarter revenue rose 17.6% year-on-year to 412.9 mln hkd.

Scene at Combine Will factory in Dongguan. NextInsight file photoCOMBINE WILL International Holdings Ltd (SGX: COMW) said its third quarter revenue rose 17.6% year-on-year to 412.9 mln hkd.

The OEM producer and maker of die mould products endured a tough operating environment, seeing its July-September profit from operations slip to 20.68 mln hkd against 27.99 mln a year ago.

Profit before tax stood at 13.37 mln hkd versus the year-earlier level of 24.83 mln.

The bottom line in the just-completed quarter slipped to 10.02 mln hkd, or 30.53 HK cents per basic share against 18.22 mln or 55.54 HK cents per basic share a year prior.

Net cash generated from operating activities stood at 31.89 mln hkd.

Meanwhile, third quarter purchases of property, plant and equipment amounted to 3.48 mln hkd compared to 47.82 mln in the third quarter of 2010.

The company’s P/E ratio stands at just 1.6x, a fraction of the sector average of 14.3x, making Combine Will worthy of further tracking.

See also:

TENFU: Tea For Two? Or Two Billion?

Photo: NextInsight

COURAGE MARINE adds 26.6 mln usd Supermax vessel to fleet

COURAGE MARINE Group (HK: 1145; SGX: CMG) added a major new vessel to its fleet.

The company said that in a “strategic move” away from the traditional dry bulk shipping setup, it disposed of two Handymax size vessels -- MV Heroic and MV Zorina -- in August and October, respectively.

Courage Marine also recently acquired a newly built Supermax size vessel from a Chinese shipyard for 26.6 mln usd, with delivery expected in January 2012.

”The acquisition shows the group’s commitment on the long-term development and efforts to explore new markets,” said Courage Marine Chairman Hsu Chih Chien.

Courage Marine, an established dry-bulk shipping company that transports raw materials for Asia’s growing energy needs, swung to a net loss of approximately 9.2 mln usd in the January-September period compared to a profit of 10 mln in the first nine months of 2010.

“The continuing market turmoil in the US and European economies resulted in increased volatility for the Baltic Dry Index (“BDI”). Despite the market uncertainties, Courage Marine managed to maintain a strong balance sheet and has repaid all its borrowings to date,” the company said.

Its net cash position stood at 14.7 mln usd as at September 30, 2011.

The group’s January-September turnover fell 56% year-on-year to approximately 15.8 mln usd due primarily to the low utilization of the fleet.

“The low fleet utilization was the result of low demand in the Asian area and the general slow-down of the global economy,” Courage Marine added.

It also recorded an one-off expense of 2.1 mln usd related to its Hong Kong listing in June.

Despite the swing to a bottom line loss over the period, Courage Marine was encouraged by recent freight rate trends, with the Baltic Dry Index (BDI) rebounding from 1,200 points in August 2011 to about 2,000 points in October.

See also: