Excerpts from analysts' reportsOSK-DMG expects Petra Foods to undertake M&A activities after..... Analysts: James Koh & Juliana Cai

|

In our recent visits to Jakarta and Manila, we observed Petra is strongly positioned for the structural growth of modern trade channels in its two core markets. Particularly, we believe its Goya brand enjoys greater shelf-space than its 10% market share suggests. We keep our BUY call and SGD4.50 TP (implying 14% upside), continuing to like Petra for its pure exposure to Asean’s two biggest chocolate confectionery markets.

|

Recent ground-checks suggest a strong position in modern trade. In Jakarta, Indonesia, Petra Food’s (Petra) products continue to dominate the chocolate confectionary shelves, with a more than 50% space. This appears to be consistent across all formats, but particularly in convenience stores. We note that foreign brands are making an effort to expand their share, paying for promotional spaces, but the appeal is still more niche, ie towards higher-end consumers.

Goya well-represented on Manila shelves. Petra has a 10% market share in the Philippines but, in our recent visit to capital city Manila, we believe Goya’s shelf-space in modern trade is higher than that. With its “premium-looking” packaging, affordable price point and wide variety, we observed many interested consumers. Petra has been steadily growing its market share since acquiring the business in 2006 and we expect this to continue, given that it is benefiting from the growth of modern trade.

M&A opportunities will add scale to the business. Since the divestment of its cocoa ingredients business in Dec 2012, management has not made any moves despite sitting on an estimated USD250m war chest. We believe M&As and/or new strategic product categories are likely to happen once ongoing litigation with Barry Callebaut (BARN SW, NR) reaches certainty, as this will add scale to its consumer business and strengthen its bargaining position with retailers.

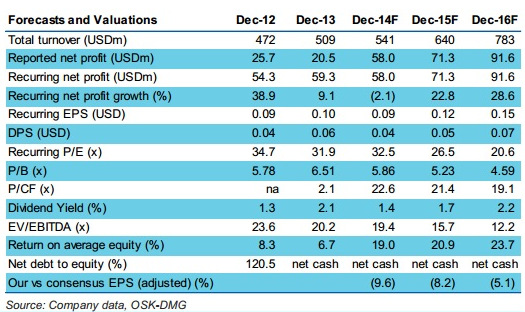

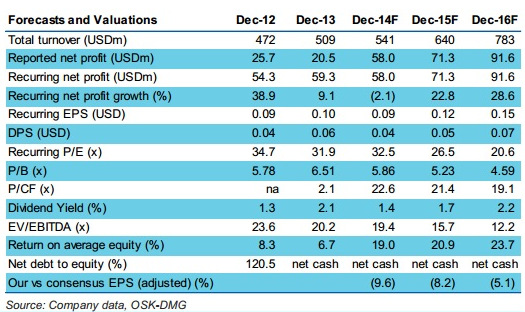

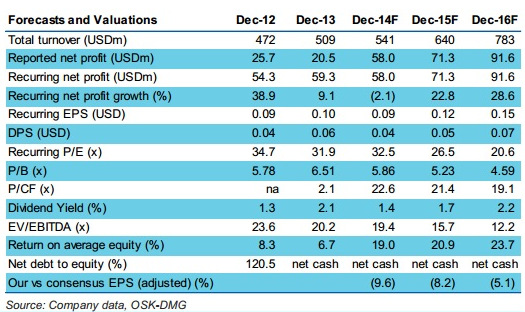

Reiterate BUY. Our DCF-based SGD4.50 TP implies 30.9x FY15F P/E. We believe a premium to its Indonesian peers (22.2x) is justifiable, given its excellent management track record and purer exposure. However, we note that the IDR’s further weakness against the USD in the last month may erode profitability, given that more than 70% of sales are still IDR-denominated.

UOB Kay Hian expects earnings recover for Super Group in 2015

|

(SUPER SP/BUY/S$1.285/Target: S$1.55) (SUPER SP/BUY/S$1.285/Target: S$1.55)

FY14F PE (x): 19.9

FY15F PE (x): 18.2

2014 is expected to remain challenging but we expect a better 2015 as its rebranding initiatives and new products/markets (China) drive earnings recovery. 2015 is expected to be a light-capex year and open up prospects of a special dividend. After a ytd decline of 32%, we think that most of a challenging 2014 has been priced in. Upgrade to BUY with a target price of S$1.55 (unchanged).

|

Look beyond 2014. The group is expected to release its 3Q14 results in the second week of November and we believe conditions will remain challenging. Whilst we see some recovery in 3Q14 on a qoq basis, selected markets such as Myanmar could continue to see challenges due to issues such as forex fluctuations (Myanmar’s kyat is down 2% qoq vs the US dollar in 3Q14). In addition, competition in selected markets such as Indonesia and the Philippines could be tough but we see that this could be partially mitigated by Super’s response in terms of new product launches and marketing campaign. In terms of top-line growth, Thailand and Myanmar are likely to decrease slightly to a flat growth whereas Malaysia and Singapore are expected to register modest growth. China is a bright spot, with strong sales momentum, and is on track to account for 8-10% of turnover from branded consumer segment.

Upgrade to BUY as a weak 2014 has been priced in. We upgrade the stock to BUY (from HOLD) after its share price has corrected 32% ytd. While we think 2014 will remain challenging as this is a “transition” year, we expect an earnings recovery in 2015 as benefits from its re-branding and new products kick in. In addition, with 2015 expected to be a light-capex year (projected maintenance capex of S$5m-6m), we estimate its cash balance could rise to over S$300m. This could raise the potential for a special dividend in the absence of any major new investment or M&A.

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors