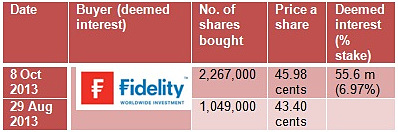

THE DEEMED INTEREST of Fidelity in baijiu producer Dukang Distillers has been raised further to 55.6 million shares, or 6.97% of the Singapore-listed company.

THE DEEMED INTEREST of Fidelity in baijiu producer Dukang Distillers has been raised further to 55.6 million shares, or 6.97% of the Singapore-listed company.A global asset manager, Fidelity first emerged as a substantial shareholder in Sept 2013 with a deemed interest of just over 5%.

Its Dukang shares are worth S$26.4 million based on the recent market price of 47.5 cents a share.

The PE ratio of 4.9X is low, given the anxiety that Singapore investors, in particular, feel about S-chips and their corporate governance and accounting fidelity.

Analysts and investors check out an outlet in Luoyang city in Henan province selling Dukang baijiu.

Analysts and investors check out an outlet in Luoyang city in Henan province selling Dukang baijiu. Photo: CompanyDukang Distillers is among a handful of Singapore-listed stocks that Fidelity has recently emerged with a deemed interest exceeding 5%. The others include ASL Marine and Sino Grandness.

Dukang also is one of a handful of China-based baijiu producers which have been bought into by fund managers or Western liquor companies.

>> London-headquartered Diageo, the the world’s largest spirits producer whose labels include Johnnie Walker whisky, acquired a majority stake in Shui Jing Fang, a premium baijiu label, in 2011.

Diageo then gained 100% control in June 2013.

Its sole ownership of Shui Jing Fang in turn raises its holding in the associated listed entity, known as Sichuan Shui Jing Fang, from 21.05% to 39.71%. (See Telegraph article)

Diageo is not just betting on local baijiu consumption raking in the cash but also Westerners taking to the drink in places such as London, Italy, Qatar, Spain, and the United Arab Emirates. In those places, Diageo will sell the baijiu drink or has begun doing so.

>> Another top liquor company, Moët Hennessy, the wines and spirits business of LVMH, the world’s leading luxury products group, acquired a 55% equity stake in Wen Jun Distillery in 2007.

The distillery is one of China’s privately-held premium white spirit companies. (See Datamonitor article)

>> Vin & Spirit, the Swedish spirits company responsible for Absolut, in 2007 entered into a joint-venture with the Sichuan-based Jiannanchun.

Subsequently, the JV and Vin & Spirit were all taken over by French liquor bohemoth Pernod Ricard (Jameson, Chivas Regal, etc.) in 2007. (See article)

Recent stories:

WE Holdings buys Europtronic (S'pore), Dukang gets Fidelity as shareholder

Comments

Can that happen now that Fidelity owns 7% of Dukang and Asdew another 1%?

Since Dukang is so profitable, req so much capex for future growth and undervalued, I will advise controlling shareholder to quickly delist and go for HK or "A" share listing.