Company photos.

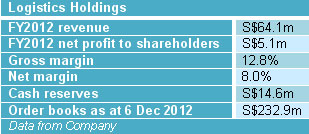

LOGISTICS HOLDINGS' order book of S$232.9 million is about four times its FY2012 revenue of S$64.1 million, and it has made a commitment to pay at least 20% of its FY2013 profits as dividends (The company's year-end is on 30 June).

The first IPO on SGX this year, Logistics Holdings is an A2 construction main contractor that will float S$39 million of shares on Catalist on Fri 18 Jan.

42.075 million shares were placed out at 23 cents apiece to institutional investors, translating into a post-placement PE of 7.7 times.

The placement tranche comprised of 31.875 million new shares and 10.2 million vendor shares from the founder and CEO, Mr Phua Lam Soon and his wife, Ms Judy Ong.

There was no retail tranche in the IPO.

S$5.96 million of the net IPO proceeds are allocated for acquiring heavy duty, large capacity automated and advanced construction equipment as well as constructing dormitories to house its foreign construction workers.

“We hope to bring more activities in-house and secure more contracts,” said Mr Phua at the company's meeting with analysts over lunch yesterday (10 Jan). Founded 27 years ago, Logistics Holdings acts primarily as a main contractor for building projects by the Singapore government and Singapore government-related bodies.

Founded 27 years ago, Logistics Holdings acts primarily as a main contractor for building projects by the Singapore government and Singapore government-related bodies.

Its recent projects included work for the HDB, MOE, Singapore University of Technology and Design, East Coast Town Council and Singapore Civil Defence Force.

"Logistics sounds like Lor Jin Tick, a Hokkien phrase which can be translated to mean straight road ahead," said executive director Eric Ng.

Mr Ng was explaining the auspicious nature of the company's unusual name.

Below is a summary of questions raised at the investor briefing and the replies made by the CEO, Mr Phua Lam Soon; executive directors Ms Judy Ong and Mr Eric Ng; non-executive director, Mr Foo Shiang Ping and financial controller, Mr Ho Chor Yau.

Photo by Sim Kih

Q: How are you affected by the recent increase in foreign worker levy?

We anticipated the rise in the levy. The levy amount has seen an up trend over the years.

We include a buffer for this increase in our tender price.

Currently, we have about 200 construction workers. 80% are them are foreigners.

We have room to hire more foreign workers as the limiting ratio on foreign workers hired by construction companies is 5:1.

Q: For what percentage of work do you rely on subcontractors?

Subcontracting accounted for about three-quarters of cost of works in FY2012. We expect this percentage to drop over the next few years, as it is our plan to do more work internally. Specialist work like piling will continue to be done by our sub-contractors.

Q: Do you have plans to expand into private sector jobs?

The government has a strong pipeline of building projects such as BTO flats as well as schools. Government projects have a much more reliable payment cycle. That is why our gearing is low. For the next couple of years, we will remain focused on government projects.

Q: Is there any pattern of revenue recognition over project life?

Billing is dependent on the project consultant’s certification of work completion.

Using a typical S$80 million project as an illustration, there is a S-curve spike in revenue recognition during the second and third years.

20% to 25% of total contract value will be collected by the first year; 70% to 80% by the third year; and the balance in the fourth year.

Q: Can you describe the scope of activities that you are engaged in?

As a main contractor, we undertake everything related to building construction. On the books, we have two income streams: About 80% of our revenue is from construction works. Another 20% is from building and maintenance.

We specialize in alterations and additions, which is part of construction works. Construction work typically generates slightly better margins than maintenance work.

Q: Do you intend to apply for A1 contractor license from BCA?

As an A2 contractor, each project we are allowed to tender is limited to S$85 million in contract value. The A1 license to tender for projects with unlimited value is given to contractors with a track record for total value of projects undertaken and group paid-up capital.

Given our strong order books, we are likely to become eligible to apply for an upgrade over the next one year.