CHINA ENVIRONMENT Ltd (SGX: CENV) is seeking a secondary listing in Hong Kong to increase three things: its daily trading turnover, its investment capital in a capital-intensive industry, and of course also its valuation.

Its Singapore-listed shares are trading at nearly year-old lows, which recently prompted DMG to initiate coverage with a BUY, and China Environment’s CFO Mr. Chiar Choon Teck told NextInsight that things are likely to soon be much rosier for the China-based emissions control equipment manufacturer due to new power plants coming on line.

He said the company was looking forward to the increased exposure to a wide range of investors following its proposed secondary listing in Hong Kong, a date for which has not yet been officially set.

NextInsight: Recently your company has been discussing a proposal to seek a secondary listing in Hong Kong. What are the main reasons for this move, and will this eventually lead to a delisting from the Singapore exchange?

Mr. Chiar: The main reasons for a Hong Kong listing are to increase share trading activity. It will widen our investor base so that we may benefit from exposure to a bigger range of private and institutional investors, and is expected to increase share trading liquidity.

Also, additional funds will provide us with the financial ammunition to take on larger projects. We intend to provide desulphurisation and de-Nox modules on top of our existing de-dusting solutions (ESP).

Your third quarter results were somewhat disappointing, with revenue and net profit both down year-on-year, but your January-September results were quite robust. Why was the July-September period so challenging for China Environment?

Mr. Chiar: Revenue was lower mainly due to power restriction measures imposed by government. China in its 11th Five Year Plan decided to reduce energy consumption per GDP by 20% before the end of 2010. So far the country has only managed to reduce consumption by 15.6%, prompting Beijing to implement power blackouts.

Power construction activity has been affected with provincial governments now having less pressure to raise power supply and more pressure to reduce energy usage, which of course cuts into our potential revenue.

However, the good news for us is that power restriction measures will be lifted by end of this year, after the end of 11th Five Year Plan. These restrictions are not a sustainable way to reduce energy usage.

In fact, they have only delayed available contracts and electricity usage will rebound strongly next year. China Environment Ltd’s outlook in 2011 remains bright when power station construction activity resumes.

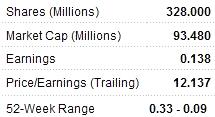

Your Singapore-listed shares are currently trading at around 0.22 sgd, which is near a 52-week low. DMG recently initiated you at BUY with a target price of 0.32 sgd, citing China Environment’s position in a fast-growing market, especially in the PRC. What is China Environment doing to maximize order growth and capacity readiness for the industrial waste gas equipment (IWE) market?

Mr. Chiar: We were allocated a plot of land of approximately 200,000 square meters by the government in August 2007. As of October 26, 2010, we have purchased 16,157 square meters of land for 4.4 mln yuan. This will increase the production capacity of the company.

The closure of outdated power plants and subsequent construction of larger, more efficient plants will definitely create the replacement demand of IWE products.

We are a pre-qualified electrostatic precipitator (ESP) supplier for 200MW and 300MW thermal power projects by the National Electric Power Planning and Design Institute (NEPPDI) and China Power Complete Equipment Co Ltd (CPCE).

In April 2010, we were certified by NEPPDI and CPCE to be capable of designing, producing and constructing ESPs for 600MW thermal power projects. With this certification together with the construction of larger and more efficient plants in the future committed by the government, we are ready to secure ever larger projects.

On top of this, with our track record in the thermal power plant construction industry, we are currently using our brand name to attract more customers in other fields including steel plants. We look forward to orders from steel plants next year.

Currently, we are working together with a Chinese partner to secure an EPC (Engineering, Procurement and Construction) power plant project in a developing country, whereby we will build a comprehensive waste gas treatment system, comprising de-dusting, desulphurisation and de-Nox modules and the Chinese partner will build other components of the EPC power plant.

In the PRC, we are also in discussions with several potential power plant customers to provide such a comprehensive waste gas treatment system.China’s IWE maker market size is slated to grow at 15% CAGR between 2009 and 2013 to hit 9.6 bln usd.

What chunk of this market do you currently have and where to you expect it to be by 2013?

Mr. Chiar: Our sales for full year 2009 were 499.6 mln yuan while January-September 2010 sales were 435.0 mln yuan, so we are growing.

Over the next five years, we can expect strong support from the Chinese government to grow the local environmental protection industry. According to media reports, officials have leaked that the government will provide financial backing of some four trln yuan to nine emerging industries, including environmental protection. The government will also be launching a comprehensive national inspection program against polluting factories under the 12th Five Year Plan to help meet its environmental targets.

To ensure that the country achieves its target of reducing carbon emissions by 40-45% by 2020, we can expect more new and efficient power plants to be rebuilt. Smaller inefficient power stations will continue to be replaced by larger new plants. This trend will be beneficial towards us.

In addition, two new key pollutants will be targeted for emission reduction: ammonium nitrate and nitrous oxide. We can benefit from these additional targets with our plan to offer de-Nox modules.

With more stringent emission control standards, together with our strategies already mentioned and along with our patented products -- especially ESLP -- we are confident that we can grow together with the industry.

How strong is your technical expertise and development versus Chinese peers and does your level of development serve as an entry barrier to potential competitors?

Mr. Chiar: Mr. Li. Liangfang heads our Technical and R&D Department. He holds a BS degree in Machinery Manufacturing and was conferred the title of Mechanical Engineer by the Fujian Bureau of Personnel in April 1996. Prior to joining us over three years ago, he worked at Fujian Long King Environment Protection Ltd, a manufacturer of dust collectors listed in Shanghai.

Our R&D team is supported by our panel of advisers namely, Mr Wang Liqian, Mr. Zhang Dexuan and Mr. Chen Shixiu.

In addition, our Technical and R&D Department collaborates with third party experts on specific research projects. The third party experts include Putian College, Wuhan University, and AE&E Energy & Environment Consulting Shanghai Co Ltd.

As a result of these collaborations with third party experts, we have successfully developed, manufactured and sold our Lentoid Dust Collector (ESLP), a hybrid collector utilizing a combination of ESP and baghouse technologies; and are poised to enlarge our solutions offerings by providing our customers with our desulphurisation and de-Nox systems and thus becoming a provider of comprehensive solutions for waste gas treatment.

ESP is a mature technology and all the industry players offer similar products except that each supplier has some patents in certain minor parts inside the ESP. Electrostatic Lentoid Precipitator (ESLP) is a class of ESPs based on proprietary patented technology of our company which we purchased full rights to in 2005. ESLP is less capital intensive and more energy efficient than conventional ESP installations. ESLP offers the advantage of a smaller plant footprint as it needs 21% less surface area and 18% less space than traditional ESPs in a case study based on a 5,000 tons per day cement plant.

Technology is only one of the important entry barriers for potential competitors. Working capital, track records and relationships with customers are also barriers and we fare extremely well in these aspects.

Is supply and demand (pure market forces) or support from Beijing the major growth driver for the IWE maker market in China now, and how do you see this ratio evolving over the next five years?

Mr. Chiar: Yes, support from the Chinese government is the major growth driver for the IWE market in China now.

See also:

CHINA ENVIRONMENT: What Analysts Say